Navigating the dynamic world of investing can be a daunting task, particularly for investors seeking to allocate their assets across various sectors. {Sector-specific ETFs, such as those tracking the S&P 500 index, offer a targeted approach to portfolio construction, allowing investors to gain exposure to specific industry trends and performances. A deep dive into the performance of these ETFs reveals valuable insights into market dynamics, enabling investors to make more strategic decisions.

- Examining historical trends in S&P 500 Sector ETF returns can illuminate sector-specific catalysts and provide a glimpse into potential future growth.

- Furthermore, analyzing the correlation between different sectors within an S&P 500 ETF portfolio can help investors minimize risk by diversifying their investments across industries with varying levels of risk.

- Ultimately, a thorough understanding of S&P 500 Sector ETF performance empowers investors to tailor portfolios that align with their individual objectives, maximizing the potential for profitability in the ever-evolving financial landscape.

Charting Sector ETF Returns: Tactics for Triumph

When exploring into the world of sector-specific ETFs, investors can unlock exposure to targeted market segments. However, navigating these volatile returns requires a well-defined approach. To enhance your likelihood of gains, consider allocating across sectors, undertaking thorough research, and persisting disciplined to your investment goals.

- Explore ETFs that track a diverse range of sectors to mitigate risk.

- Analyze the historical performance and prospects of individual sectors before investing capital.

- Stay informed about industry developments that could affect sector returns.

Keep in mind that past performance is not indicative of future results, and engaging in ETFs carries inherent uncertainty. Consult a qualified financial advisor to build an portfolio strategy that meets your personal needs and aspirations.

Unlocking Top-Performing S&P 500 Sector ETFs: Identify The Winning Picks

Are you looking to maximize your portfolio returns? Then consider diving into the world of S&P 500 sector ETFs. These funds offer a flexible way to participate in specific industry sectors, allowing you to tailor your investments based on market trends. Researching the top-performing ETFs across various sectors can reveal hidden gems. From healthcare, each sector presents unique risks. By carefully choosing the right ETFs, you can position your portfolio for profitability.

- Leverage proven data and analysis to pinpoint ETFs with a strong track record of performance.

- Diversify your investments across various sectors to mitigate exposure.

- Monitor the performance of your chosen ETFs periodically.

Capitalizing in S&P 500 Sector ETFs: Diversification and Growth Opportunities

The S&P 500 index is a bellwether of the U.S. equity market, representing a diverse range of industries. Individuals seeking to capture growth potential while reducing risk can leverage Sector ETFs that track specific segments within the S&P 500. These ETFs provide a focused approach to investing, allowing participants to allocate their capital to sectors with favorable growth prospects. By diversifying across various sectors, investors can potentially moderate volatility and enhance overall portfolio returns.

For example, an investor bullish on the technology sector could invest in a Technology Sector ETF, gaining exposure to leading tech companies within the S&P 500. Conversely, an investor seeking more stable growth might prefer a Utilities Sector ETF. The advantages of this approach are multifold, offering investors control in tailoring their portfolios to align with their individual objectives.

Unveiling Sectoral Opportunities: A Guide to S&P 500 ETFs

The vibrant S&P 500 boasts a expansive array of sectors, each offering unique opportunities for investors seeking targeted exposure. Sector-specific ETFs provide a focused way to deploy capital within these areas. By utilizing the power of ETFs, investors can maximize their portfolio performance while managing risk.

A thorough understanding of different sectors and their fundamental drivers is essential for building a successful investment strategy.

- Evaluate the ongoing economic environment.

- Study historical data within each sector.

- Delve into individual companies and their financial positions.

By applying a systematic approach, investors can optimally exploit the complexities of the market and realize the full promise of S&P 500 ETFs.

Analyzing S&P 500 Sector ETFs

Navigating the complexities of the financial markets can be daunting, but sector-specific Exchange Traded Funds (ETFs) offer a targeted approach for investors seeking exposure to particular industries. The S&P 500 encompasses a wide range of sectors, providing a diverse landscape rank my trade for investment consideration. By delving into the performance and trends within individual sectors, investors can make more informed decisions about their portfolio allocation.

One effective strategy involves analyzing the recent performance of S&P 500 sector ETFs. Monitoring key metrics such as performance can shed light on sectors that are presently experiencing growth or facing headwinds. It's also important to consider the future outlook for each sector, taking into account factors like economic trends .

A well-diversified portfolio often benefits from exposure to multiple sectors. This can help mitigate risk by spreading investments . Remember, thorough research and a clear investment plan are essential for navigating the complexities of sector-specific ETF investing.

- Evaluate your investment goals before choosing ETFs.

- Keep abreast market trends and news that could impact sector performance.

- Rebalance your portfolio periodically to maintain your desired diversification strategy .

Andrew Keegan Then & Now!

Andrew Keegan Then & Now! Hailie Jade Scott Mathers Then & Now!

Hailie Jade Scott Mathers Then & Now! Lynda Carter Then & Now!

Lynda Carter Then & Now! Jane Carrey Then & Now!

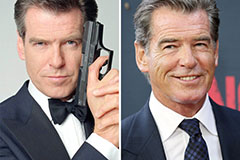

Jane Carrey Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now!